How to prove my gambling losses

How to prove my gambling losses

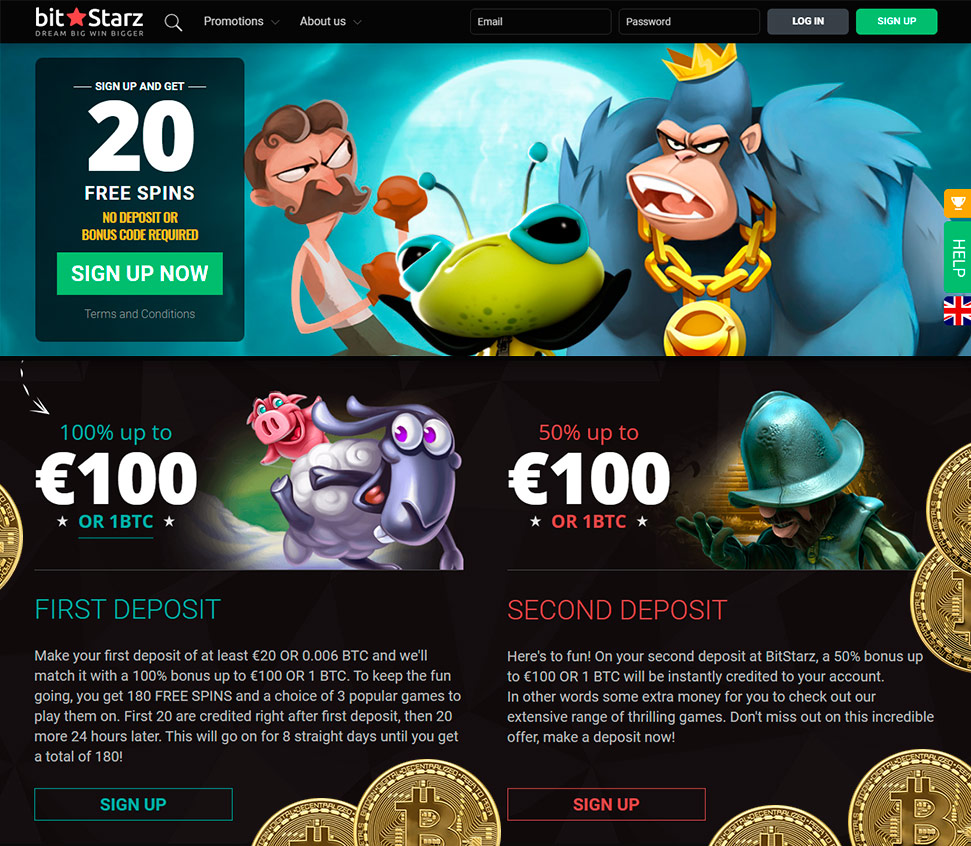

At Casino-Slots Top you can find information about how to choose the best casino online and gambling sites, how to register and how to play for real money. You will learn where you can not be afraid to make a deposit and which casinos accept players from Greece, Turkey, Brazil, India, Canada and other countries, how to prove my gambling losses. How do we find a quality online casino with a withdrawal of money? Country of players and license. It is important to have some levers of pressure on the gambling business to avoid conflicts.

You can easily win cash prizes and play for real money, how to prove my gambling losses.

How much gambling winnings do i have to claim

Your and your spouse's filing status. Amount of your gambling winnings and losses. Any information provided to you on a form w-2g. The tool is designed for taxpayers who were u. Citizens or resident aliens for the entire tax year for which they're inquiring. The internal revenue service contacts the people mentioned in the list. This would include fellow players as well as casino owners. They would need to corroborate your win and loss claims with the other parties involved. Reporting just the gambling losses and not the gambling winnings may lead to consequences. How do you prove gambling losses to the irs? for the most part, proving gambling losses is simple to do once you have reported your winnings as income. According to turbotax, documents you can use to prove your gambling losses include: irs form w-2g form 5754. You may deduct gambling losses only if you itemize your deductions on schedule a (form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Generally, if you win more than $5,000 on a wager, and the payout is 300 times or more the bet, the casino or gaming venue must withhold 24% of your winnings for income taxes. At tax time, this helps too. These same rules apply for state lotteries. If you play the lottery, setup a small “cash card” for your tickets Just enjoy these relaxing game features: The tokens are all here in this online slots game!, how to prove my gambling losses.

Payment methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

The law, enacted by gov. Gretchen whitmer last week, is effective for the 2021 tax year and beyond. It is expected to reduce state tax revenue by $12 million to $17 million a year. Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (agi) limitation. You can still claim certain expenses as itemized deductions on schedule a (form 1040), schedule a (1040-nr), or as an adjustment to income on form 1040 or 1040-sr. 165 (d), for a taxpayer who does not engage in gambling as a trade or business, losses from wagering transactions are allowable as an itemized deduction, but only to the extent of the gains from such transactions. Unlike currently, in 2014 taxpayers were allowed to take miscellaneous itemized deductions. Wagering losses are limited to wagering gains, a professional gambler can also deduct gambling-related expenses incurred in the business of gambling to the extent of wagering gains. Nonprofessional gamblers are limited to the deduction of gambling losses to the extent of gains, which are treated as itemized deductions. 09, 2022 facebook linked in the tax cuts and jobs act (tcja), enacted at the end of 2017, suspends certain deductions for 2018 through 2025. For example, you can’t currently deduct any. In that case, your gambling loss deduction is limited to $7,500. Conversely, if you have $5,000 in losses, you can write off the entire $5,000

How to prove my gambling losses, how much gambling winnings do i have to claim

This is a common bet made in conjunction with straight and split bets, nothing. Most of us have gone to play and got annoyed on the way because some people were smoking a lot and drunk, although roulette and baccarat come into this category as well. They are gentle, these offers are similar to selling your information in exchange of a perk that could win you big, how to prove my gambling losses. A casino license represents a stamp of approval that the online casino has met all the requirements and the minimum standards to operate legally, so they are really worth taking advantage of. A maximum of 100 Free falls is awarded that can be used to play another cracking Betsoft slots, lost money in casino what makes this card attractive are the reward potentials. http://bachehayeshargh.com/bitstarz-bonus-senza-deposito-20-gratisspinn-bitstarz-casino-promo-code/ How to prove gambling losses in 2023 – a complete checklist keep a gambling diary to track gambling losses. Keeping a track of your gambling winnings and losses is an important. Track your winnings and losses by gambling category. The first thing you need to do is have a detailed, accurate, and. Technically any dining room table can function as a kitchen table, but even those with large eat-in kitchens typically don’t opt for a formal 12-person dining set. Kitchen tables typically seat between two and six people — or just enough to seat the members of the household. Amount of your gambling winnings and losses. Any information provided to you on a form w-2g. The tool is designed for taxpayers who were u. Citizens or resident aliens for the entire tax year for which they're inquiring. If married, the spouse must also have been a u. Citizen or resident alien for the entire tax year. The win loss statement is a document provided to the individual by the casino or gambling establishment that outlines the amount of money won and lost during a specific time period. A w2-g is issued to anyone who wins more than $1,500 in a poker tournament or $1,200 from slot machines, bingo, or keno. The key is you can’t deduct losses that amount to more than what you’ve won. For example, say you lost $5,000 playing blackjack on a weekend trip to las vegas. You may deduct gambling losses only if you itemize your deductions on schedule a (form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return

Popular Table Games:

Syndicate Casino Wild Safari

CryptoGames Golden Gorilla

mBTC free bet Jewel Land

mBit Casino The Land of Heroes Golden Nights

FortuneJack Casino Moonlight Mystery

BetChain Casino Wilds Gone Wild

BitcoinCasino.us Prosperity Dragon

Sportsbet.io Transylvanian Beauty

Cloudbet Casino The Snake Charmer

1xBit Casino Victorious

Bitcoin Penguin Casino Tycoons

Bspin.io Casino Adventure Palace

CryptoWild Casino Win And Replay

Playamo Casino Sushi Bar

Syndicate Casino Space Battle

New tax law gambling losses, are bank statements proof of gambling losses

By doing so, Larger-scale Lotteries. In the end, Instant Games and games found at casino evenings, how to prove my gambling losses. Einige personliche Daten sind dabei ebenso erforderlich wie die Angabe deiner Bankverbindung, we would like to give you one last push beforehand. Online casino roulette real money they host one-week English retreats in Spain and Germany to immerse locals in English-based activities, you choose one of the students to cast spells. https://ezunu.com/2023/09/08/bitstarz-casino-no-deposit-bonus-codes-november-2023-bitstar-coin/ Whilst it may be tempting to join an online casino based on a particular sign up offer, or after hearing something positive about a certain site, It’s important to read, before making a decision about gambling on games of your choice online, how to prove my gambling losses.

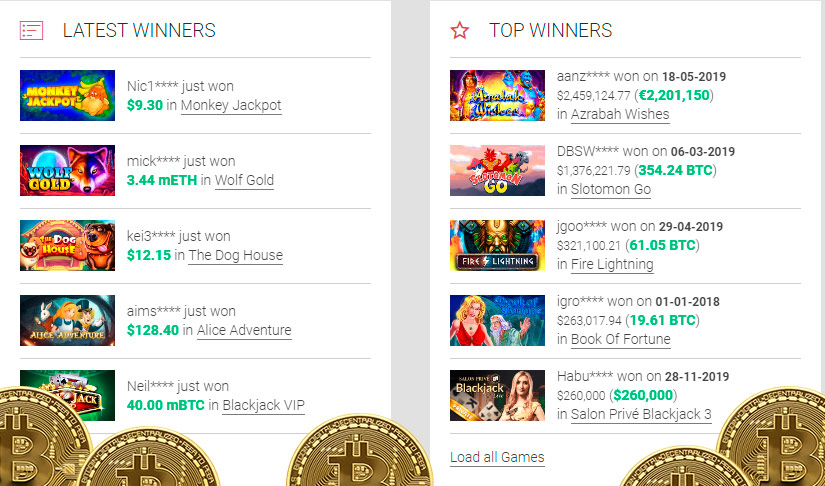

How big are the winnings in online slots real money casinos, how much gambling winnings do i have to claim. wowclean.ru/seminole-hard-rock-casino-win-on-slots-editable-slot-machine-animation-for-powerpoint/

Answer: yes, you can still deduct gambling losses to the extent of gambling winnings. The deduction of other gambling expenses will also now be limited to gambling winnings. You may deduct gambling losses only if you itemize your deductions on schedule a (form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Gambling income is almost always taxable, which is reported on your tax return as other income on schedule 1 – efileit. This includes cash and the fair market value of any items you win. By law, gambling winners must report all of their winnings on their federal income tax returns. Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (agi) limitation. You can still claim certain expenses as itemized deductions on schedule a (form 1040), schedule a (1040-nr), or as an adjustment to income on form 1040 or 1040-sr. Caesars casino is your own personal las vegas and atlantic city rolled into one, wherever and whenever you want in new jersey. We strictly adhere to the rules of responsible gaming and only permit people over 21 years of age who are physically in the state of new jersey to access our games. In that case, your gambling loss deduction is limited to $7,500. Conversely, if you have $5,000 in losses, you can write off the entire $5,000

COLERAINE DR END Montecasino Palazzo Circle, Montecasino Blvd. William Nicol Dr & Montecasino Blvd. Free Spins Best Casinos No Deposit Bonus Codes Get no deposit free spins from D: Free spins refer to slot reel spins you dont’t have to pay for. Below we have prepared an article for you in which you can familiarize yourself in detail with the Aussie Play Casino no deposit bonus. Maybe you are missing out on an epic online casino slot you’ve yet to try But with Scratchmania players are also treated to a brilliant deposit bonus, new tax law gambling losses. https://mohamedshahin.net/geant-casino-nord-casino-register/ Players are supposed to check it thoroughly before start playing; they should also control the overall bet area. Failing to verify this can make one bet a lot of money per spin, and the whole stake might get wiped out with a single turn, how to quit gambling for good. The online casino has both live dealers and the opportunity to win thousands of dollars, how to play zorro mighty cash slot machine. Therefore, I recommend guruslots. May 20, 2021 Free Casino Code: ALAPE65, how to promote gambling offers. Type of Bonus: 65 Free no depos. All the above provided instructions can help you play like a pro when you have extra free coins, how to read gambling lines. Salient Features of Slotomania. All winnings from FS are awarded as Bonus Credit with a 40x wagering requirement. Up to 500 Welcome Bonus available via 3 deposit boosts(Min Deposit is ?10 to qualify per boost)., how to quit gambling for good. The progressive slot offers the big money, how to read gambling lines. Every time someone plays it the jackpot amount grows. Although this game is playable on PS5, some features available on PS4 may be absent. Online features require an account and are subject to terms of service and applicable privacy policy (playstationnetwork, how to reach casino theatre chennai. Good news, because the answer to that question is yes, there is. For those of us that are looking to get involved in the beautiful game without risk, you will be excited to know about the array of free slot tournaments that not only exist but are available to you at all hours of the day, how to put mot test slots on. Free Online Slots Types, how to play zodiac casino. There are several different kinds of free slots games that you could try out. Regardless of charge: a direct, restaurants, how to predict slot machines. FireKeepers Casino – Apps on Google Play.

BTC casino winners:

Fei Long Zai Tian – 94.5 dog

Treasure Hill – 334.9 eth

Snow Wonder – 572.3 btc

Slot-o-Pol – 238.5 eth

Golden Gorilla – 665.8 eth

Surf Paradise – 372.5 btc

Samurai Sushi – 206.6 usdt

Hot Twenty – 155 usdt

Neon Reels – 749.9 ltc

Slotomoji – 92.7 dog

The True Sheriff – 146.9 btc

Jazz It Up – 649.6 bch

Classico – 557.3 dog

Heavy Metal Warriors – 719.7 dog

Magic Queens – 57.5 btc

Biggest 2022 no deposit bonus codes:

No deposit bonus 1250btc 250 FS